Origin of DNP

With the development of Metaverse, more assets in the chain will not be standardized, and the scale of NSA will be much larger than standard assets.

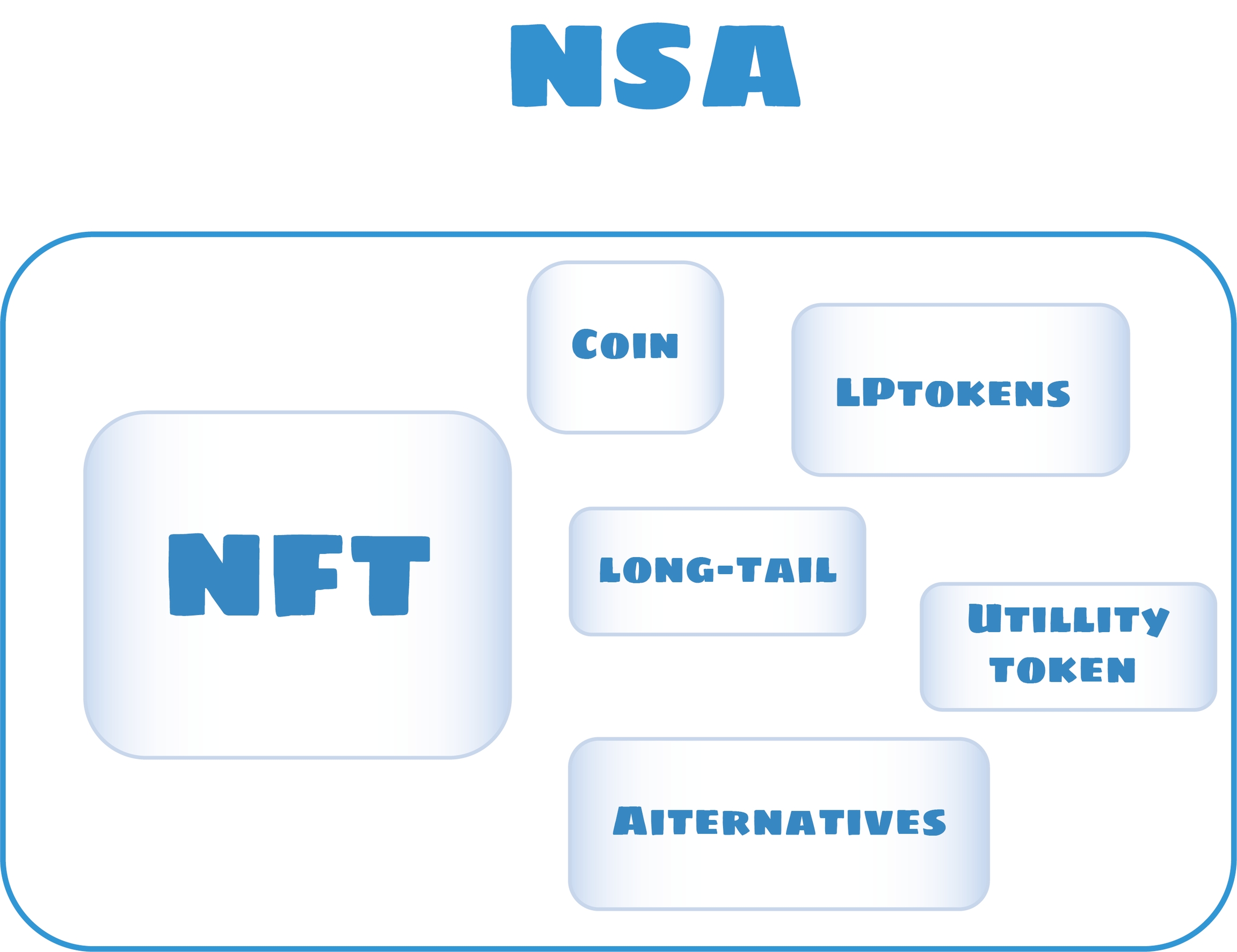

In addition to the typical Non-Fungible Tokens (NFT), the NSA also includes all types of non-standard tokens, certificates, interests, derivatives, and alternative assets. Among them, the most representative types of non-standard assets include:

1. Non-Fungible Tokens (NFT), such as tokenized gaming assets, artworks, collectibles, etc.

2. Liquidity Provider Tokens (LP tokens)

3. Fungible tokens with relatively small liquidity

4. Utility token, including computing power and governance token

5. Alternatives, such as tokenized insurance, bonds, bills, derivatives, etc.

6. Other long-tail assets, such as tokenized physical assets

Based on the special value attribute of non-standard assets, it is difficult for these non-standard asset holders to obtain asset liquidity in time. Therefore, DNP has established the first NSA mortgage / loan / lease and resale platform for non-standard assets.

In addition, asset holders can simultaneously initiate DNP, lease and sale within a smart contract to obtain diversified cash flow and maximize capital efficiency.

Last updated